Recession visits the economy from time to time as a part of economic cycle. It brings in its train tumultuous times on the one hand and a host of business opportunities on the other.

Meaning Of Recession

Recession means contraction in business cycle caused by any of the factors such as:

- Financial crisis.

- Any external trade shocks.

- Any adverse supply shocks.

- Bursting of economic bubble.

- Natural disaster.

- Pandemic like CARONA – COVID 19.

When Gross Domestic Product-GDP of the economy declines for two consecutive quarters, Recession is said to have set in. With the contraction of the economy businesses and individuals prefer not to spend money, invest or take business risks. On the other hand, need of the hour is to conserve cash to ensure survival of business in tumultuous times.

It is noteworthy that industries meeting inelastic demands of customers are not disturbed by the phenomenon of Recession.

Small businesses and Start-ups in particular are quite vulnerable to adverse impact of Recession.

“Unfortunately, in a Recession the people who suffer the most aren’t the rich, but the wane-be rich and the poor”

(Robert Kiyoski)

It is imperative to make your business Recession – proof. It warrants:

- Focus on revenue preservation.

- Efficient cash flow management.

- Investment in strategic demand generation.

Assisted by technology, it is possible to analyse, measure and monitor progress in direction of action.

Want To Make Your Business Recession Proof?

Then comply with Basic Pricing Guidelines and Guard your Business from the Pitfalls.

- Determine the cost of delivery of the product or service to customers. Here, exclude the overheads.

- Estimate your overheads to work out ‘Break – even’ point. This will help to ascertain your required volume of sales.

- Incorporate your desired profit and calculate this into price.

- Keep a vigil on your Margin to ensure it is not being eroded by increased costs.

- Understand your customer satisfaction levels.

- Dissatisfied customers will not pay premium prices.

- Regularly review prices.

- Make small increases to cover increased costs.

- It is advisable to make small regular price increases at intervals throughout the year than one large increase just once a year.

Remember.

It is the right time to apply.

The 80/20 Rule implying that 20% of your customers, products or services will provide 80% of your business.

Assessment Of Risk Tolerance Capacity

It is absolutely essential to assess the risk tolerance capacity of your business. Here, you are required to ponder over certain questions such as:

- Break-even point of your business.

- Capacity of leaders and staff to handle uncertainty.

- Adaptability of your systems and processes to emerging situation.

- Your risk taking capacity for potential losses.

- Your ability to withstand any risk to your business reputation.

How To Whither Storm Of Recession?

To thrive in business even in the midst of Recession you must as successful business owner:

- Evaluate your monthly expenses.

- Create and maintain an Emergency Fund.

- Create an alternative Revenue Plan.

- Analyse your Investment Pan.

- Analyse your Cash Flow management strategy.

- Pay off your highest debt forthwith.

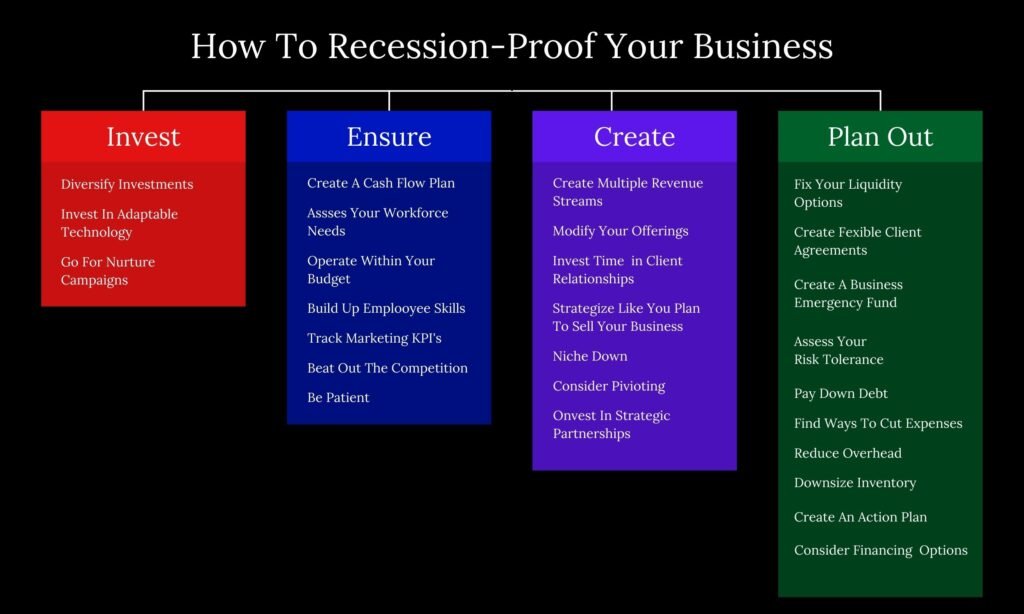

Under How to Make your Business Recession Proof

Steps To Make Your Business Recession Proof

- Create a Marketing Plan for concrete action.

- Explore additional business opportunities.

- Secure involvement and participation of your team.

- Explore low cost product ideas for the benefit of your customers.

- Introduce internal cost-cutting measures.

- Measure your KPIs-Key Performance Indicators.

In a Nutshell

- Build up your business credit.

- Make workable business forecast.

- Create and maintain solid relationship with customers.

- Keep constant vigilance over business numbers.

- Maintain your investment in marketing.

- Explore multiple revenue streams.

Proactive Strategy To Recession Proof Your Business

1. Formulate Business Plan

A solid Business Plan must be prepared to combat repercussions of Recession.

Main focus should be on building a financial forecast that includes:

- Profit & Loss

- Cash Flow

- Balance Sheet

Efforts should be made to ensure that your forecast is fully interconnected to provide for changes to your revenue in your P & L.

A a one-page business plan should be prepared to keep it handy whenever required.

2. Experiment With Different Scenarios

Try to experiment with different financial scenarios to asses impact on cash and profits in different situations.

Experiment with a slowdown to your entire business as also slowdowns to specific revenue streams.

Working through different scenarios will help attune your business to various emerging situations.

3. Concentrate On Managing Cash Flow

Management of Cash Flow assumes special importance.. It tests your ability to keep enough cash in the bank in different situations.

Try to make to keep your cash balance stable. This is where having interlinked financial forecasts is very useful so that changes to one part of your forecast are automatically reflected everywhere.

You must ensure timely receipt of payment from your customers.

Build systems to keep your accounts receivable under control.

4. Investigate A Line Of Credit

Building a cash cushion, or a “rainy day fund” is essential for your businesses. Most businesses spend much of their cash reinvesting into the business to fund additional growth. You may contemplate opening a business line of credit to use as a cash cushion. Ideally, you wouldn’t use this line of credit unless you absolutely need it and it will cost your business very little to maintain it, -only incurring interest and fees when you borrow from it.

5. Tie Marketing Expenses To Revenue

A helpful budgeting strategy is to link certain spending to revenue.

Instead of creating a specific budget for something like marketing, you forecast that spending as a percentage of revenue. Using this method, you can keep spending in check if sales start to decline or automatically ramp the budget up if sales are better than expected.

6. Review Cycle Of Plan

Review your plan regularly and track your progress against it.

With the help of a financial reporting dashboard you can easily generate reports and see if you are meeting your sales goals and keeping to your spending budget. Schedule a monthly review meeting to go over your numbers .Make adjustment in your forecast based on how your business is performing.

In a financial crisis you should increase that review cycle and check your numbers more frequently.

7. Diversify Target Markets

To combat Recession, diversification of target markets renders substantial help.

8. Tweak Pricing Models

It is prudent to explore different pricing options. Different approaches to selling can unlock new business. Consequently, you can make your products and services accessible to customers that may be hesitant to commit during times of uncertainty.

9. Build Strong Relationships

During Recession, relationships are of paramount importance. It is very much required if payment of rent is deferred or payment to vendors required to be delayed. It will be much easier if you have established, trusting relationships in place, work to cultivate those relationships before a crisis hits so that it is easier to seek favours when needed.

Building solid relationships with your customers during good times will help keep them with you when times are tough. Enjoying their trust shall go a long way in turbulent times of Recession.

10. Be Open To Change And Diversify

To face Recession with all your strength you should be pragmatic. Be ready to give your business a new direction, if so required. It may be fruitful exercise to change your business completely. Brain storming to explore various alternative scenarios can aid in difficult times of Recession.

In Retrospect

There is absolutely no doubt that Recession posess strong challenge to businesses of all hues. Patience and perseverance of business owners are put to acid test. However, silver lining is that crisis of Recession is not insurmountable After all, it presents an opportunity for:

- Organization of marketing channels.

- Efficacy of team management.

- Creativity in business.

Business environment holds the key. Smart and farsighted business owners like you apply the solid rules of financial management. Perhaps, that is the only way to survive shocks of Recession and place your business on road to sustainable profit trajectory.

”During Recession, greed dies, frugality survives.”

(Amit Kalantri)